Cross posted from Scaling Green. Is there any good reason why we can’t do this in Virginia?

The conventional wisdom to date has generally been that a carbon tax would help the environment but would hurt the economy. For instance, the National Association of Manufacturers (NAM) – not exactly an unbiased source, to put it mildly – found a parade of horrors from a carbon tax. For instance, NAM claimed that “any revenue raised by the carbon tax would be far outweighed by the negative impact to the overall economy” and that “increased costs of coal, natural gas and petroleum products due to a carbon tax would ripple through the economy and result in higher production costs and less spending on non-energy goods.” The question is, should we take anything NAM says on this subject seriously? A few facts to consider in making that judgment include:

The conventional wisdom to date has generally been that a carbon tax would help the environment but would hurt the economy. For instance, the National Association of Manufacturers (NAM) – not exactly an unbiased source, to put it mildly – found a parade of horrors from a carbon tax. For instance, NAM claimed that “any revenue raised by the carbon tax would be far outweighed by the negative impact to the overall economy” and that “increased costs of coal, natural gas and petroleum products due to a carbon tax would ripple through the economy and result in higher production costs and less spending on non-energy goods.” The question is, should we take anything NAM says on this subject seriously? A few facts to consider in making that judgment include:

- In April 2009, NAM “protested the Environmental Protection Agency‘s finding that greenhouse gas (GHG) emissions endangered public health and could be regulated under the Clean Air Act.”

- “In 2009, Duke Energy, which operates scores of coal-fired power plants in the Southeast and Midwest, would not be renewing its membership due to NAM’s refusal to address global warming.”

- “After losing a legal challenge” and being forced to list its membership, we learned that NAM members included major fossil fuel firms and organizations like coal-heavy American Electric Power, the American Petroleum Institute, BP, Chevron, the Edison Electric Institute, Exxon Mobil, Koch Industries, Marathon Oil, Shell Oil, etc.

In sum, NAM is dominated by fossil fuel companies and fossil-fuel-intensive manufacturers, making it about the last group around you’d want to take advice from – or trust – when it comes to energy policy. Fortunately, it turns out that the conclusions of NAM’s carbon tax “study” have been completely contradicted by economic modeling firm REMI. The study, entitled “Environmental Tax Reform in California: Economic and Climate Impact of a Carbon Tax Swap,” is available at this link. Here are the key points.

- Levels of carbon pricing modeled in the study are $50/metric ton, $100/metric ton, and $200/metric ton.

- “The first $4 billion/year in revenue is always for a fund meant to grow renewable investments.”

- Beyond the first $4 billion slated towards renewable energy, the rest of the money raised from the tax would be returned to Californians, either in the form of an across-the-board tax cut (e.g., to income, sales, and corporate taxes) or via a a “‘fee-and-dividend’ paid out to households modeled on the Alaska Permanent Fund.”

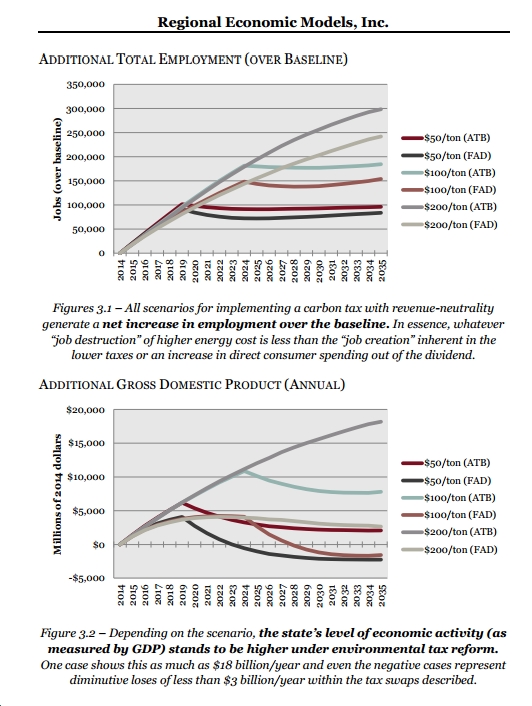

- The “tax swap” could mean 300,000 more jobs in the state by 2035, an extra $18 billion in GDP, an additional $16 billion in annual income, and carbon emissions less than 75% of 1990 levels.

- The results, as you can see in the graphs above, are major increases in economic output and employment levels. For instance, assuming a $200/metric ton carbon tax, combined with an across-the-board tax cut, the REMI model finds that California would see 286,475 more jobs and an additional $18 billion/year in Gross Domestic Product by 2035.

- Almost every sector of the economy does well under the revenue-neutral carbon tax, with the exception mainly of fossil fuel extraction and processing, as well as fossil-fuel intensive manufacturing. In contrast, there is a long list of economic sectors that stand to gain from the revenue-neutral carbon tax, including construction, retail trade, food service and drinking places, financial services, healthcare, furniture, wood products, paper, and motion pictures and sound recording.

- With regard to carbon emissions, REMI’s model sees sharp reductions from baseline levels, as consumption of carbon-based fuels decreases, while non-carbon-based energy sources like wind, solar, and energy efficiency boom.

It should be noted that the REMI study of California study was not a fluke in any way, as REMI’s research has also found positive results from a revenue-neutral carbon tax for Massachusetts and Washington State. The bottom line is that, in case after case, a revenue-neutral carbon tax not only doesn’t hurt the economy, it helps it significantly. All while slashing carbon pollution and providing a major boost to non-carbon-based energy sources liked wind and solar. That certainly qualifies as a “win-win” outcome in our books. Now, it’s just a matter of states realizing this and enacting such a policy into law.

Sign up for the Blue Virginia weekly newsletter

Sign up for the Blue Virginia weekly newsletter